With both Bank Nifty and Nifty 50 currently reaching all-time highs, investors and traders frequently find themselves pondering which stocks offer the best investment opportunities. In this article, we will introduce three banking stocks that possess robust fundamentals yet are currently trading at significantly discounted valuations. Let’s know about the bank stocks to buy now.

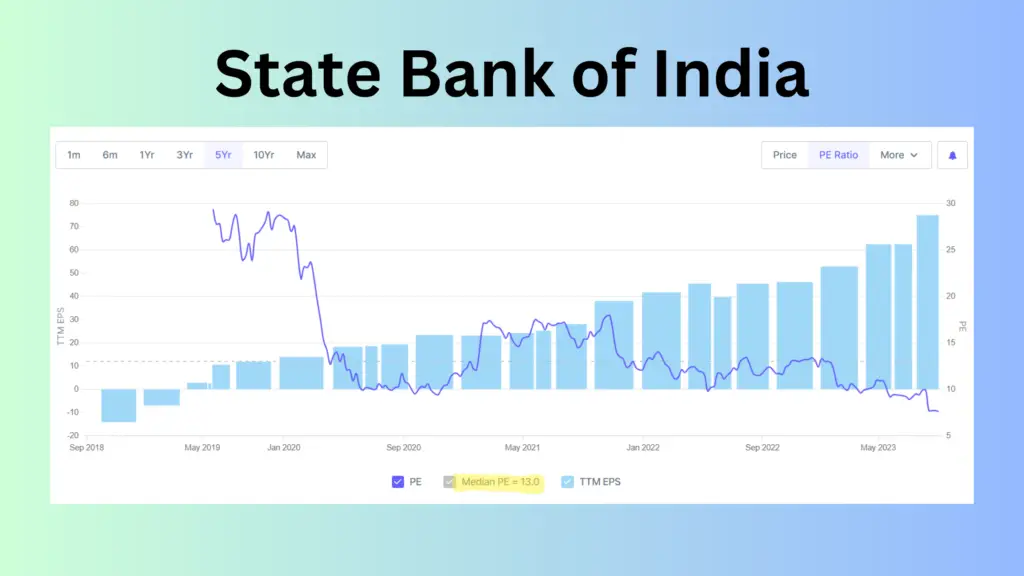

State Bank of India (SBI)

SBI, a prominent Indian multinational public sector bank, currently boasts a price-to-earnings (PE) ratio of just 7.6, considerably lower than its median PE of 13, which can potentially reach up to 30. The bank has achieved an impressive sales growth of 26% and a remarkable profit growth of 65%. SBI’s revenue has surged to INR 19,094, marking the highest-ever net profit on both a quarter-on-quarter and year-on-year basis. Additionally, its Net NPA has dwindled to a mere 0.7%.

Axis Bank

As the third-largest private sector bank in India, Axis Bank is presently trading at a PE of 13, well below its median PE of 31, which has the potential to surpass 80. The bank has demonstrated robust sales growth of 32% and profit growth of 41%. With revenue soaring to INR 26,246, Axis Bank has achieved its highest-ever revenue figures. Moreover, the company has posted an unprecedented trailing twelve months (TTM) net profit of INR 12,630, coupled with a commendable return on equity (ROE) of 14.5%.

Read More: Stock to buy now : TCS

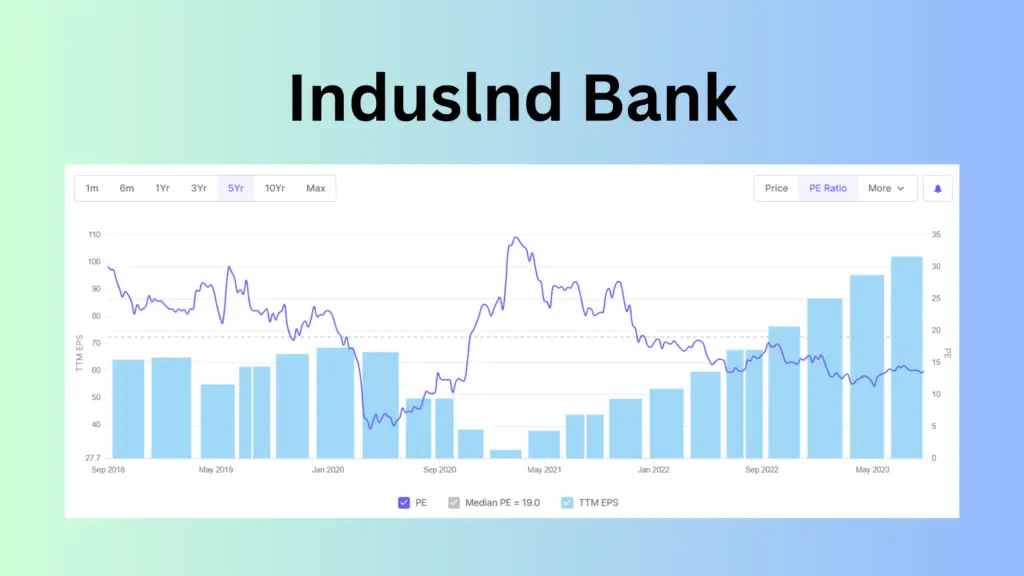

IndusInd Bank

Established in Mumbai in 1994 as the first private sector bank in India, IndusInd Bank currently trades at a PE of 13.8, significantly below its median PE of 19. During bullish market conditions, IndusInd Bank often garners a PE of 30. The bank has exhibited a solid sales growth of 24% and a substantial profit growth of 51%. Notably, its performance in the June quarters has outshined both the previous quarter and the corresponding quarter of the previous year, resulting in record-high sales and net profits, ultimately propelling its share price to historic highs.

India, as a rapidly growing country, is poised for continued growth in its banking sector, making these undervalued banking stocks potentially lucrative investments.

Conclusion

Jio Financial Services is well-positioned to grow rapidly in the coming years. It has a strong parent company, Reliance Industries, which provides it with financial backing and access to a large customer base. The company also has a strong management team with a proven track record of success.

Overall, Jio Financial Services is a well-run company with a strong growth potential. It is expected to play a major role in the Indian financial services sector in the coming years.

Read More : Balaji Amines Share Price Target