Zomato Share Points to note

Positive Points

- Positive Net Profit for September quarter 2022.

- FII increased its holding from 10%- 58%.

- Reserves increased 4 times in 7 years

- Cash of 1200 Cr.

- Increased in share price with huge buying volumes.

- Sales increased every quarter, every year.

- Other Income accounts for profit of the company.

Negative Points

- Core business loss-making.

- Increased sales increased the losses.

- Operating profit is always negative.

- Cash Flow is always negative.

- Other Income goes up and down.

- Investment in this stock may be speculation.

Zomato Is one of the leading food services platforms in India.IT services include food delivery, dining out, loyalty programs, and others. Customers use the platform to search and Discover restaurants, read and write customer reviews, upload photos, book a table etc. They also provide restaurants with industry-specific marketing tools to acquire customers and grow their business.

The business segment of Zomato

Zomato operates in business segments:-

- Food delivery

There has been a rapid growth in food delivery in India in past few years. Zomato orders have increased by 13 x. The food delivery system includes customers, delivery partners, and restaurants.

- Dining out

Customers use the Zomato platform to book tables for dining out at a restaurant. Restaurant partners pay the company for enhanced visibility on its platform.

- Hyper pure

Directly supplies fresh, high-quality ingredients directly from farms to their restaurant partners making the supply chain more effective.

- Zomato Pro

It is a paid membership program, where Zomato Provides flat percentage discounts to its customers at selected restaurant partners.

International footprints of Zomato

Zomato is actively working in 23 countries including Australia, UAE, New Zealand, Malaysia, USA, Poland, etc.

Acquisitions of Zomato

The company has acquired More than 14 acquisitions with 6.4% stakes in Curefit Health Pvt. Ltd.

The growth story of Zomato

The company is planning to launch Online grocery services, after its investment in Blink It. It is also using integrated Technology e off artificial intelligence, machine learning, and data science to drive innovations on its platform for its customer, delivery partners, and restaurants.

Fundamental Analysis of Zomato

A 45,000 Cr. Market cap company is trading at a CMP of 59.5 with 52 weeks high as 169 and 52 week low as 40.6. It is an almost debt-free company.

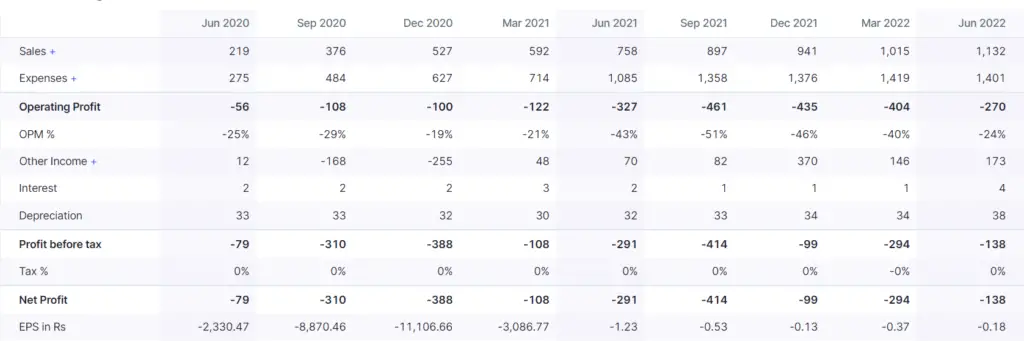

As you can see above Zomato has shown increase in sales in every quarter but that has not accounted for any profits for the company. With increased sales, expenses are also increasing and operating profit remains negative. Although the company has reduced its losses from 294 Cr. to 138 Cr. from Mar 22 to Jun 22, but still Rs 270 Cr. loss in one quarter means a loss of Rs 800 Cr. annually. This loss is compensated by other income but the core business remains unprofitable. Other Income cannot be predicted and cannot be relied upon in business.

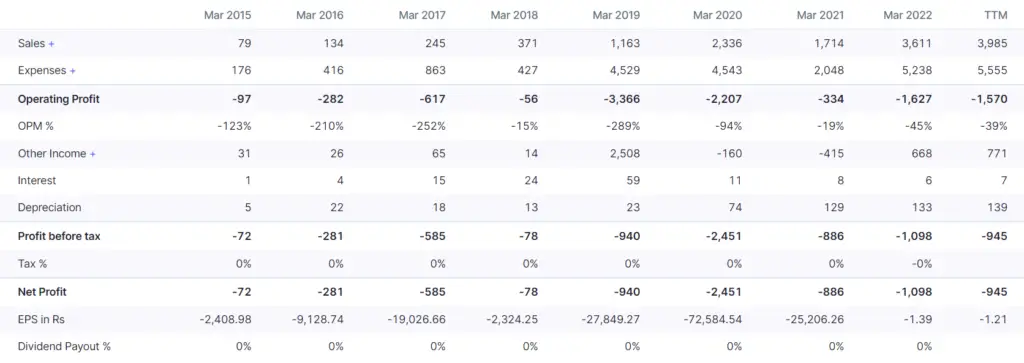

Again continued increase in sales can be seen in Profit and Loss statement on yearly basis and expenses are also growing with same pace. In business there are some expenses which remain fixed and after that expenses don’t grow much with sales. But that is not true for Zomato. It is may be due to the discounts offered with Zomato are deducted from Company’s Profits itself. The YoY losses have Increased from 886 Cr. to 1098 Cr. Again other income is not same or organized in the P&L statement. Sometimes it is very less, some times negative and sometimes high. This is very unreliable.

Reserves of Zomato are increasing and they have doubled from Mar’21 to Mar’22. Borrowing is also negligible. This is the only positive point in entire financials. They have increased their fixed assets, investments and other assets.

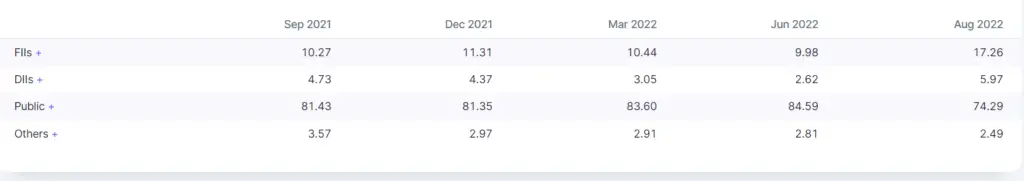

Shareholding pattern shows that promoters have came out of the stock after IPO. FII’s have increased their holdings in Aug’22 and now possess 17.26 % of holdings. DII’s are constantly decreasing their shareholdings in this Zomato. Most of the company is in Retailer’s hands i.e more than 74%. Good companies usually have retailer’s holding less than 25%.

It is still a loss-making company from which retailers should make a distance. Although the share price showed an up move of 47% from 28 July 22 to 3 Aug 22.

What should new investors do?

New investors should stay away from this stock for time being. Wait for Zomato Ltd. to post good quarterly results for at least two quarters. Although its stock has gone up with high buying volumes. Don’t follow herd that everybody is buying and taking about Zomato so should I. Always invest in profit making companies. When it will post profits, there will be chance to buy it. All companies irrespective of good or bad go up and down giving investors chance to enter. Wait by that time. If it had been a good stock then why FII and DII are moving out of it.

Can Zomato Become Multi-bagger?

Zomato is having huge data of its customers. It very well now what is getting sold at what price in which area. It may open its consultancy firm to advice new businessmen about restaurant business. This can open good opportunities for Zomato. But by that time it is posting losses because of discounts it is giving. It is a very high risk stock. I recommend investing only after two quarters of profit.

Already invested people should wait and come out of the stock when it moves up with market trends.

Technical Analysis of Zomato

As such no chart pattern can be observed in Zomato. No investing on the basis of Technical charts as well.

Read About Multibagger Stocks Like Lux Industries Or Vaibhav Global Ltd.

Read About Multicap Stocks which are value investing in 2022.

Frequently Asked Questions

Should New investors invest in Zomato?

Zomato is a loss making company. Investors should always invest in Profit making companies. Investors should consider investing in Zomato when it starts posting positive results.

What is target of Zomato share 2023

Zomato can reach to Rs.72.30, II target Rs. 80.15

Is Zomato’s price target of Rs 220 achievable in 2024-25?

It is difficult to time the market. Company targets to breakeven by 2024. Good prices of stock are expected from a profit making company.

Why Zomato stock is falling?

Zomato stock is falling because it is posting losses. FII and DII are constantly selling their stakes

Use the link to open a Demat account in Zerodha

Also read

- Coal India Ltd, buy or sell

- Avenue Supermarts Ltd| DMart | A high-growth company with an opportunity to invest

- Can you tell me anything to change my mind about quitting the stock market for good?

- How to select stocks for investing in 2022. How to select great companies for investing for beginners.Want to invest in Stock Market, but don’t have time and skills, try SWING TRADING

- Market capitalization-Which companies qualify to be in my portfolio?

- छोटी-छोटी आदतों से खुद को सुधारें

- Power of your subconscious mind. Explanation .आपके अवचेतन मन की शक्ति|व्याख्या हिंदी में| Treasure house within you| आपके अंदर निहित खजाना| Chapter 1

Books on Investing

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Learn to Earn: A Beginner’s Guide to the Basics of Investing and Business

One Up On Wall Street: How to Use What You Already Know to Make Money in the Market

The Intelligent Investor

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing.