Gland Pharma, Mphasis is Mid Cap stocks to buy now 2022 for multi-bagger results.

Quality Mid Cap Stocks to invest in September 2022

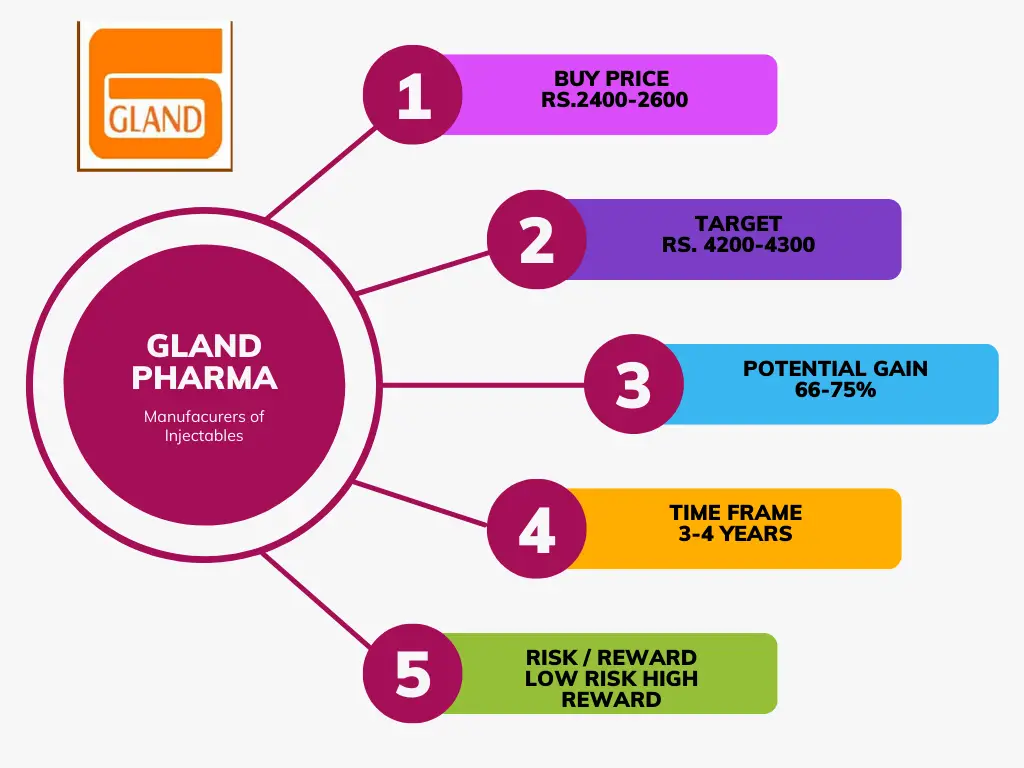

Gland Pharma

Gland Pharma was established in 1978 in Hyderabad, India. Company is primarily into contract manufacturing of small volume liquid injectables. It is promoted by Shanghai Fosun Pharma, a global pharmaceutical major. It has global footprints in 60 countries like U.S., Europe, Canada, India, Australia etc. 71% revenue is generated from US. It has a portfolio of 215 approved ANDA filings.

The company is a debt free company with ROCE as high as 24.8%. The company has delivered good profit growth of 23.9% CAGR over last 5 years. Jun 22 quarter results have been lower than Jun 21 which also accounts for drop in share price of the stock. If we look at the profit and loss statement FY22 has shown highest ever sales, highest ever operating profit and highest ever Net Profit.

Reserves has grown to double since FY’19. There is a CWIP of 191 Cr. which explains increased expenses and decreased Operating profits in Jun’22 quarter. DIIs have increase their holdings by more than 5% since Sep’21. The company is trading near its 52 week low and their is an upside potential of 75% upto its Lifetime high.

Key Points Of Investment Gland Pharma

| Sector | Pharma | |

| Industry | Contract Manufacturing of injectables, Footprint in 60 Countries. | |

| ROCE | 24.8% . Very Good | 🤗 |

| Debt to Equity | 0 | 🤗 |

| Quarterly Results | Improved QoQ Results for Sep’21, Dec’21, Mar’22 Quarters. Disappointing results in Jun’22 because of decreased sales | 😞 |

| Profit and Loss Statement | Continuous increased sales, operating profits, Net Profits since Mar’11. Not a single year when sales or profit has not increased. | 🤗 |

| Balance Sheet | Continuously increasing reserves, No borrowings, Continuous Increasing Fixed Assets, other Assets. CWIP of of 191 Cr. Ever since Mar’11 there is some or other CWIP going on. That means company is constantly expanding | 🤗 |

| Cash Flow | Whatever is coming as profits it is getting converted into Cashflow. | 🤗 |

| Share Holding Pattern | Promoters holding 58%, FIIs decreased holding by about 2% ad DII increased their holding by more than 5% | 🤗 |

| Buy Price | Rs. 1700-1750 | |

| Target Price | Rs. 4200-4300 | |

| Gain Potential | 147% | |

| Time Frame | 3-4 years |

My Opinion For Buying Gland Pharma

The current Price is very near 52 weeks low. There was a huge volume when the stock touched 52 week low. If the vision is for 3-4 years then Gland Pharma could be bought till lifetime high of Rs.4314 thereby having a potential of around 75%.

Also Read About another multibagger stock Vaibhav Global Ltd.

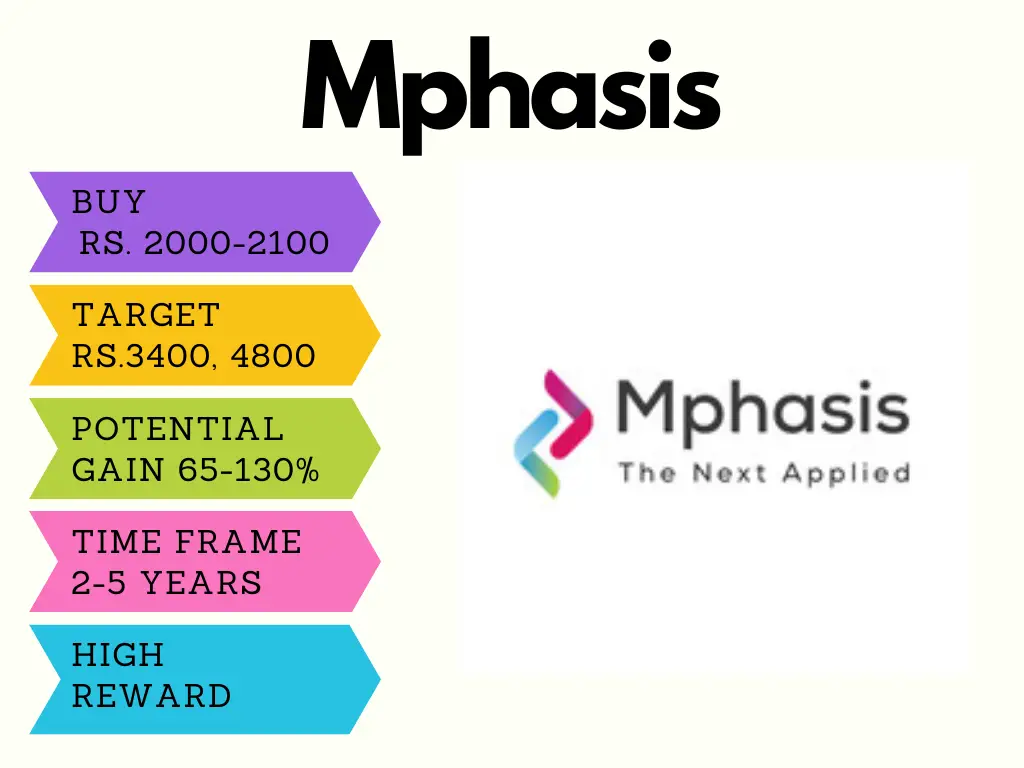

Mphasis

Mphasis is a next gen technology company that help enterprises transform business globally. It uses exponential power of cloud to provide hyper personalized digital experience to clients and their end customers. They provide solution for Cloud Service, Blockchain Technology, Autocode.AI. This midcap company has potential to turn into a multibagger.

Mphasis has a virtually a debt free company with a very high ROCE of 27.4%. The company has shown a profit growth of 16.5%. It is also paying a healthy dividend payout of 71.8%.

The company has shown highest ever sales, highest ever operating profit and highest ever net profit in QOQ basis. The company has shown a continuous increase in sales ever since FY’11. Operating profits and Net Profits are increasing ever since March’14. FY’22 has shown highest ever sales and highest ever profits both operating and net.

Balance sheet shows ever increasing reserves, very very less borrowings. After FY’16 fixed assets have been growing considerably with increase in gross block. There is a considerable reduction in building and plant machinery from FY’15 to FY’16, which seems sorted now. CWIP of 11 Cr. marks some sort of expansion.

Cashflow is positive and coherent with Net Profit. Promoter’s Holding is 56%, FII 20.5%, DII 18%. Retail investor is left with only 5.5% of share holdings. The company is trading near 52 week low, and their is an upside potential of 73% till lifetime high. A complex reverse head and shoulder pattern is in the making. If it is formed company can go upto levels of Rs. 4800 giving 130% returns.

Key Points Of Investment Mphasis

| Sector | IT | |

| Industry | Cloud Service, Block Chain Technology, AI | |

| ROCE | 27.4% . Very Good | 🤗 |

| Debt to Equity | 0.08 | 🤗 |

| Quarterly Results | Improved Sales and Net Profit on QoQ Basis. Highest ever quarterly Sales and Net Profit | 🤗 |

| Profit and Loss Statement | Continuous increased sales since Mar’11. Not a single year when sales has not increased. Mar’14 witnessed poor results, although sales were high, after that there is constant increase in net profit. | 🤗 |

| Balance Sheet | Continuously increasing reserves, No borrowings. CWIP of of 11 Cr. Ever since Oct’11 there is some or other CWIP going on. That means company is constantly expanding | 🤗 |

| Cash Flow | Whatever is coming as profits it is getting converted into Cashflow. | 🤗 |

| Share Holding Pattern | Promoters is increasing their holding, FIIs decreased holding from 28% to 20% and DII has increased their holdings from 13% to 18% | 🤗 |

| Buy Price | Rs. 2000-2100 | |

| Target Price | Rs. 3400, Long Term Target- Rs 4800 | |

| Gain Potential | 65-130% | |

| Time Frame | 2-5 years |

My Opinion For Buying Mphasis

It is a digital world and India is turning digital. From UPI payments to e Commerce everything is turning digital around us. This means Company has huge growth prospects. This is a mid cap company which has huge potential to turn into a multibagger stock. The company is trading at low levels and has potentials to go high. A patient investor with long term vision can invest in this stock to get good results. IT companies have just touched life time high and may undergo consolidation for some time. This may affect the performance of Mphasis as well. Investing with long term vision can only help.

Also Read About another Multibagger Stock Lux Industries

Frequently Asked Questions

How much should we invest in these mid cap stocks?

Always invest 3-5% of your portfolio in one stock.

What should be the stop loss?

When we invest with full faith in one stock, after through study, there is no need of stop loss. Hold shares even if they go down after buying. Hold shares until and unless there is something wrong in profit and loss statement or balance sheet.

What is Mphasis target price in 2025, 2030?

Target Price of Mphasis 2025 is Rs. 3400, for 2030 is Rs 4800. Right now these are the two targets and both of them may be achieved before 2030 also.

Use the link to open a Demat account in Zerodha

Also read

- Why do price of Stock fall down as soon as I buy and rises up when I sell?मेरे खरीदते ही Stock Price गिर जाता है और बेचते ही Stock Price बढ़ जाता है|

- क्या एक आम आदमी शेयर मार्केट में पैसे कमा सकता ? क्या शेयर बाजार में निवेश करके 1 Crore रुपए कमाए जा सकते हैं?

- Can you tell me anything to change my mind about quitting the stock market for good?

- How to select stocks for investing in 2022. How to select great companies for investing for beginners.

- Zomato targets to break even by the second quarter of FY24.

- Coal India Ltd, buy or sell

- Want to invest in Stock Market, but don’t have time and skills, try SWING TRADING

- Market capitalization-Which companies qualify to be in my portfolio?

Books on Investing

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Learn to Earn: A Beginner’s Guide to the Basics of Investing and Business

One Up On Wall Street: How to Use What You Already Know to Make Money in the Market

The Intelligent Investor

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing.