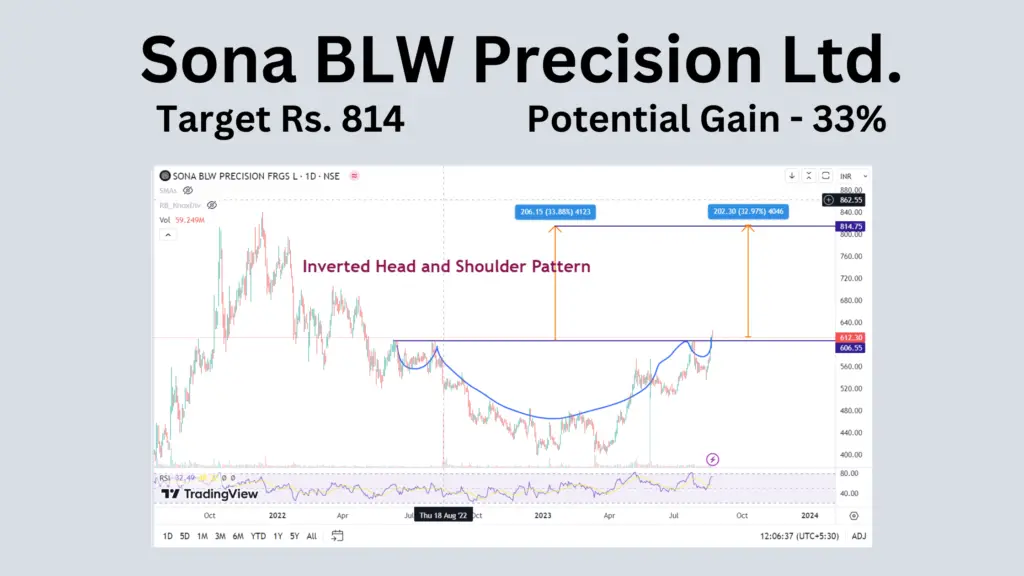

Reverse Head and Shoulder formed in the technical charts of Sona BLW Precision Ltd. giving it a potential target of 33%.

Sona BLW Precision Share Price

Sona BLW Precision Forgings, an Indian automotive technology company, specializes in designing, manufacturing, and supplying engineered automotive systems and components. Their product portfolio includes differential assemblies, gears, conventional and micro-hybrid motors, BSG systems, and EV traction motors across various vehicle categories.

Sona BLW has secured its position as a prominent player in the automotive industry. It ranks among the top 10 global differential bevel gear suppliers, top 10 global starter motor suppliers for PVs, and stands as the largest manufacturer of differential gears for PVs, CVs, and tractors in India.

Read More : Jio Financial Services Share Price Prediction

Sona BLW Precision Share Price Target

A reverse head and shoulder pattern is formed in Sona BLW technical chart where neckline is formed at levels of 606 . Target of Rs. 814 can be achieved if this pattern succeeds giving a potential gain of 33% from current levels of 610. A breakout candle if formed with its closing point above Rs. 612 then the breakout is confirmed.

Other Factors which further confirm the target achievement are:-

Excellent Q1FY24 Performance

Sona BLW posted consolidated net profit of INR 112 crore for the quarter ending on June 30, 2023, signifying a notable 48% surge compared to the corresponding period in the previous year. The company also witnessed a remarkable uptick in revenue from operations, reaching INR 731 crore, marking a substantial growth of 24.95% year-on-year.

Increased FII Holding

Demonstrating a positive sentiment towards the company’s future prospects, the Foreign Institutional Investors (FII) and Foreign Portfolio Investors (FPI) ownership stake in the enterprise surged to 31.68% by June 30, 2023, showcasing a significant increase from the 24.69% reported on March 31, 2023. This heightened foreign investment underscores growing optimism among international investors.

Read More:- IRCTC Share Price Target

Promoters increasing their stakes in Adani Enterprise

Noteworthy strategic activity emerges as the promoter group of Sona BLW Precision Ltd. augmented its stake in Adani Enterprises Ltd. from 5.23% to 5.76%. This calculated move is aimed at securing a strategic position within the burgeoning renewable energy sector, reflecting the promoter group’s forward-looking initiatives.

Read More : IEX Share Price Target

Investment in EV Component

In a forward-looking endeavor, Sona BLW Precision Ltd. is gearing up to channel an investment of INR 1,000 crore over the next five years. This capital infusion is directed towards the establishment of a cutting-edge manufacturing facility exclusively dedicated to electric vehicle (EV) components. The company’s visionary approach aims to cater to the evolving needs of major domestic and international automakers seeking reliable EV components.

Sona BLW Precision Financials

- ROCE- 22%, ROE – 18% Excellent

- Profit growth 22.8%

- Sales Growth – 26.9%

- Low Debt to Equity 0.13

- Highest ever YoY Sales and Net Profit.

- Reserves grown from negative to 1705 Cr.

- 91 Cr. CWIP

- Fixed assets doubled from 793 Cr. to 1588 Cr.

- Cashflow has always been positive and inline with Net Profit.

- FIIs increase holding from 13.89 to 31.68%.

- DII increased their holding from 15.16 to 28.20%.

- Public holding just 10.35%

Notably, Blackstone exited its 20.5% stake in Sona BLW Precision Forgings, marking a significant development in the company’s ownership structure. Promoter’s holding decreased to 29.76% from 53% in last two quarters.

Read More : Balaji Amines Share Price Target

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true. We are not SEBI-registered analysts.