IRCTC Buy Range:- Rs. 600-650 Target:- Rs. 3030 by 2030.

IRCTC share price| IRCTC share analysis| IRCTC share price target|

IRCTC is the first company which has started online ticketing for Indian Railways. It is a monopoly stock and is available at very attractive valuations.

Investing in the share market is very tricky. An idea of the future growth of the company and the share prices it can achieve can give us a little more conviction to invest and stick to the share of our choice.

If you want to know whether what is the right time and right price for investing in IRCTC then this article is for you.

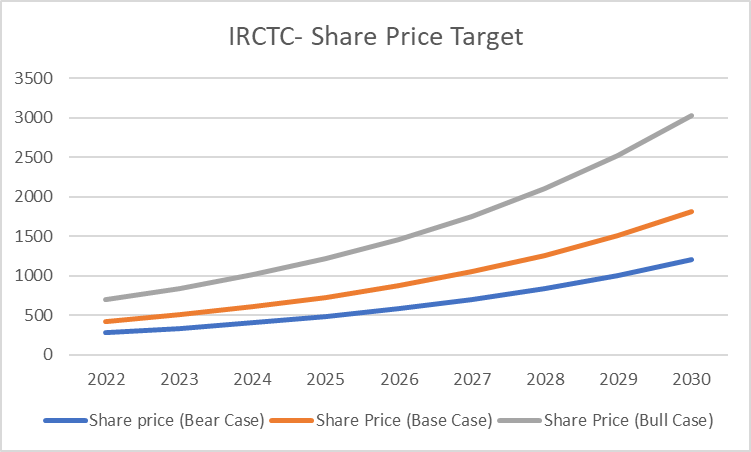

If you want to invest in IRCTC, lets come together and calculate where IRCTC can reach in coming 5-7 years. Below is a sneak peak of results of our calculations.

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2022 | 282 | 423 | 705 |

| 2023 | 338 | 507 | 846 |

| 2024 | 406 | 609 | 1015 |

| 2025 | 487 | 731 | 1218 |

| 2026 | 584 | 877 | 1461 |

| 2027 | 701 | 1052 | 1753 |

| 2028 | 842 | 1262 | 2104 |

| 2029 | 1010 | 1515 | 2525 |

| 2030 | 1212 | 1818 | 3030 |

IRCTC Share Price Today

About IRCTC

- Indian Railways Catering and Tourism Corporation Ltd. is a mini Ratna enterprise under the Ministry of Railways.

- The core activities of the company are:-

Catering & Hospitality

Internet Ticketing

Travel and Tourism

Packaged Drinking water (Rail Neer)

- It is a Large Cap company with Mcap as Rs 48000 Cr.

IRCTC Financials

The company has recorded a ROCE and ROE of 51% and 40% respectively.

Debt is negligible with the Debt to Equity ratio being 0.08.

The Company has shown a Profit Growth of 69.6%.

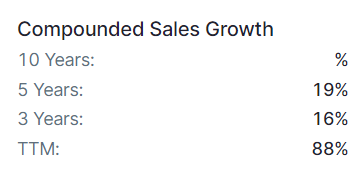

CAGR Sales have been 114% TTM.

CAGR Profit has been 24% in the past 5 years, 33% in the last 3 years, and 70& TTM.

Sales and Profits have grown on QOQ basis and reported as highest ever in December 2022 quarter.

Sales have grown from 1059 Cr. in 2015 to 3267 Cr. in TTM.

Operating profits have grown 8 times during this period from 152 Cr. to 1230 Cr.

Net Profits have grown 7 times from 131 Cr. to 941 Cr.

Reserves have grown 5 times from 424 Cr. to 2078 Cr.

Fixed assets have doubled.

Cashflow is always positive.

FII’s have increased their holdings from 1.7% to 6.84%in past two years.

DII’s have increased their holdings from 2.25 to 8.73% in past two years.

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | TTM | |

| Sales | 1,059 | 1,367 | 1,520 | 1,466 | 1,870 | 2,264 | 777 | 1,879 | 3,267 |

| Operating Profit | 152 | 190 | 314 | 274 | 383 | 703 | 188 | 881 | 1,230 |

| OPM | 14% | 14% | 21% | 19% | 20% | 31% | 24% | 47% | 38% |

| PAT | 214 | 309 | 355 | 346 | 479 | 730 | 258 | 890 | 1,263 |

| Reserves | 424 | 522 | 747 | 915 | 911 | 1,154 | 1,296 | 1,724 | 2,078 |

| Borrowing | 0 | 0 | 0 | 0 | 0 | 0 | 79 | 107 | 178 |

| Fixed Asset | 155 | 159 | 170 | 190 | 182 | 285 | 311 | 335 | 383 |

| CWIP | 16 | 14 | 17 | 8 | 40 | 16 | 24 | 26 | 31 |

| Other Assets | 990 | 1,264 | 1,639 | 2,122 | 2,372 | 2,941 | 2,818 | 3,476 | 4,128 |

| Cash from Operating Activites | 69 | 288 | 338 | 24 | 499 | 409 | 248 | 524 |

Read More:- SBI Cards Share Price Target

Calculating IRCTC Share Price Target

- Here we will try to calculate the future prices of IRCTC by predicting its future sales and earnings. This will give us a broad vision for long-term investors.

- By looking at the historical data we will assume how the company is going to perform in the future.

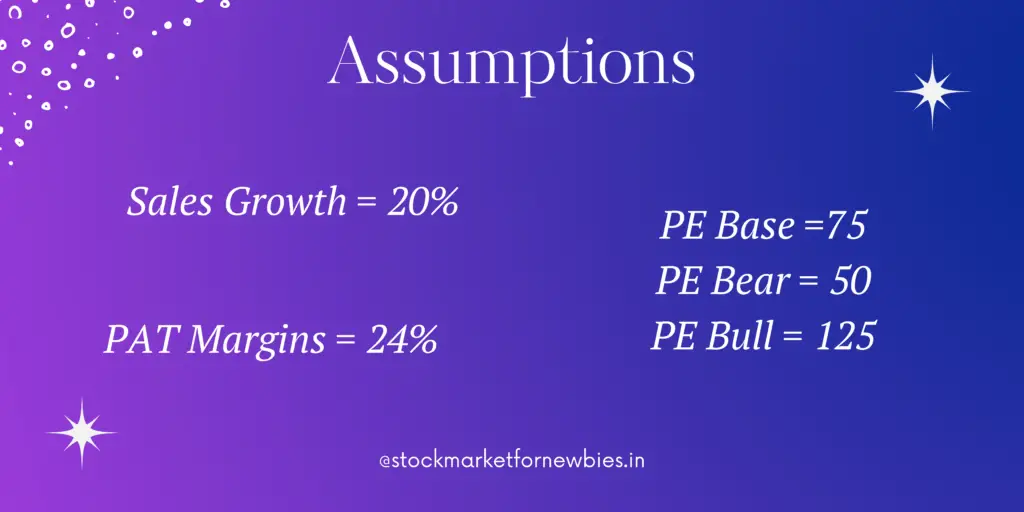

- For this we need to assume sales growth the company will show in the future, PAT margins, and PE that could be given to it by the share market.

Read :- Zomato Share Price Prediction

Assumed Sales Growth

- The CAGR Sales of IRCTC have been 4% in the past five years but in TTM it had been 114%.

- Past 2-3 years the entire travel industry suffered due to Covid 19, hence sales growth has been meager in past years.

- This sales growth will definitely grow now because of two reasons. Firstly increased digitalization and secondly launching of new Vande Bharat trains which will have a positive impact on IRCTC sales.

- Being conservative let’s assume that Sales Growth as 20% for our calculations.

Read : JK Paper Share Price Target

Profit After Tax Margin

- IRCTC operates on high operating margins from 19% to 47%.

- But to calculate earnings we need to have PAT margins .

- Historical PAT Margins have increased from 15 to 35% since 2015.

- Average PAT Margins come out to be 24%.

- So, we will assume PAT Margins as 24% for our calcualtions.

Read:- Nippon India Share Price Target

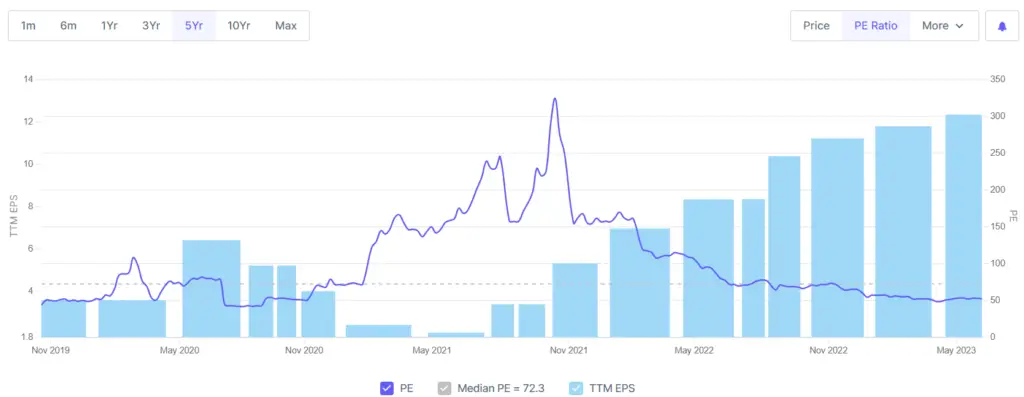

PE

The financials of a company remain the same for a quarter but its share price keeps going up and down every day. This is due to market emotions. Market emotions could be measured through PE.

In past five years PE of IRCTC had been between 42-324 with median PE being around 70-75.

- Base Case – When the market tends to be neutral towards a share it is the base case. In this case the share price mimics the financials of the company. If the net profit increases the share price also increases. Let’s assume PE in this case as 75.

- Bear Case – When the share market becomes pessimist about the company, it starts giving low PE to it and the share prices falls down drastically. Let’s take PE as 50 in this case.

- Bull Case – When the market becomes highly positive towards a company and looks at bright future of the company it starts giving it a higher PE. In this case let’s assume PE as 125.

Base Case – 75

Bear Case – 50

Bull Case – 125

Number of Shares

The company has 80 Cr. of shares.

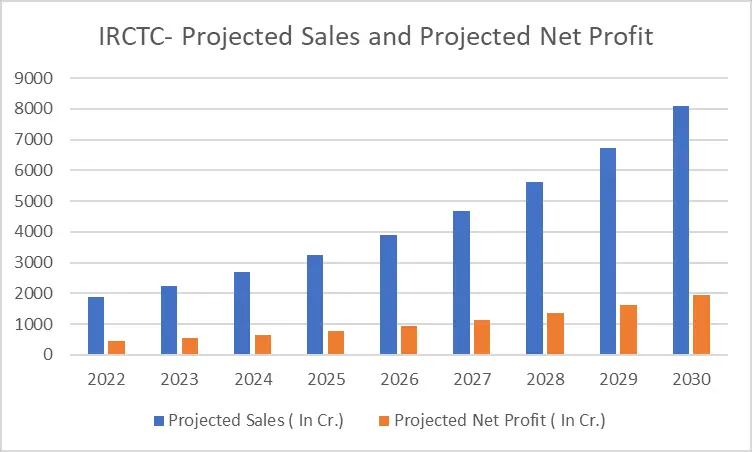

Calculating IRCTC Projected Sales and Net Profit

- We will calculate Projected sales of IRCTC by assuming that sales will grow by 20% every year.

- Projected Sales (Next Year)= Sales Current Year + X% of Sales Current Year, where X= Assumed Sales Growth.

Eg:- Projected Sales 2023 = Sales 2022 + 20 % Sales 2022.

- Assuming PAT margins as 24% we can calculate the projected profits of IRCTC.

- Projected Profit = Projected Sales X Profit After Tax Margin

- Historic data can be fetched from www.screener.com

| Year | Projected Sales ( In Cr.) | Projected Net Profit ( In Cr.) |

| 2022 | 1879 | 451 |

| 2023 | 2255 | 541 |

| 2024 | 2706 | 649 |

| 2025 | 3247 | 779 |

| 2026 | 3896 | 935 |

| 2027 | 4676 | 1122 |

| 2028 | 5611 | 1347 |

| 2029 | 6733 | 1616 |

| 2030 | 8079 | 1939 |

IRCTC Share Price Target 2023

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2023 | 338 | 507 | 846 |

In 2023, the Share Price of IRCTC could range from Rs. 338 to Rs. 486. Whenever the share price of IRCTC touches 338 levels or it goes below that it would be right time for investors to enter this stock.

With COVID situations improving and people started travelling again, the earning patterns of IRCTC are expected to improve.

IRCTC will be handling all operations of Vande Bharat trains. It is already providing service in 17 Vande Bharat trains.

More Vande Bharat trains are expected to launch soon in future.

With new Vande Bharat trains launch, sales of IRCTC are expected to rise and so the profits. New Vande Bharat trains are positively correlated with the growth of IRCTC.

Convenience fees is also a great source of revenue which is expected to grow further.

IRCTC intends to extend the reach of its online ticketing operation to other forms of transportation like planes and buses. Additionally, it intends to roll out a variety of additional features on its website and mobile app, including dynamic pricing and real-time seat availability.

For this, IRCTC is investing heavily in technology to improve its operations and services. This includes developing new software and hardware, and upgrading its IT infrastructure.

IRCTC Share Price Target 2024

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2024 | 406 | 609 | 1015 |

IRCTC is focusing on obtaining a payment aggregator license for iPay.

Revenue is expected to grow from non convenience fees resources such as loyalty programs, PG integration, PG portions and IT earnings.

Tourism revenue is expected to grow which would bring better sales for IRCTC.

Catering segment would grow in 2024 and there would be stabilized margins from thereon.

People being more health conscious , Rail Neer revenues are expected to grow thereby improving margins.

Contracts for 675 touchscreens for train side vending and more train contracts are already in pipeline which are expected to start giving results by this time.

IRCTC Share Price Target 2025

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2025 | 487 | 731 | 1218 |

IRCTC has already awarded with contracts of pantry cars in all the trains. In trains with no pantry cars, TSP directions contract is being awarded. This will help in serving of freshly prepared meals to the tourists. These new services will bring upon new revenue resource.

With launch of Bharat Gaurav Series, where journey is undertaken in trains in form of tourist packages where services like off board travel and excursion by buses, hotel stay, meals, tour guides, insurance etc. is provided. These trains provides immense luxury and convenience to its customers.

These Bharat Gaurav packages are affordable, safe with meals according to different religion. We expect that these kind of packages are expected to become popular among the travelers benefiting IRCTC.

IRCTC is starting two new plants in Bhubaneswar and Simhadri to increase Railneer production capacity which is expected to get functional soon . By 2025, IRCTC is expected to meet 80% of railway’s water requirements therby adding to revenue stream.

IRCTC is planning to diversify into new businesses, such as e-commerce, food delivery, and logistics. It also plans to set up its own chain of hotels and restaurants.

IRCTC is constantly developing new products and services to meet the needs of its customers. This includes launching new tour packages, introducing new food items, and offering new online ticketing features.

IRCTC Share Price Target 2030

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2030 | 1212 | 1818 | 3030 |

IRCTC is constantly trying to tie up with B2C partners so as to increase the number of stations and booking. With acquiring more stations, sales are expected to grow and hence the profitability of the company.

The company has very high operating margins. With slight increase in the revenue, profitability increases many folds.

IRCTC is trying to improve its services in booking by introducing WhatsApp booking where there is a service of two way communication.

IRCTC is focusing on operational measures to provide better services to customers and creating brand value to its business.

IRCTC intends to increase its international presence by opening offices in new countries. It also intends to collaborate with overseas travel companies in order to provide its products and services to international passengers.

Conclusion

- IRCTC is a fundamentally strong stock with a lot of growth opportunity.

- It can give good results to its investors.

- Investors can invest in IRCTC whenever there is a correction in the share price. One should always buy a share when it is available atleast at its 52 weeks low to make maximum profit.

- Investors can use the above date for an idea of when to buy and when to sell.

- Bear case data could be used as buy points and Bull case data could be used as targets.

Click here to read IRCTC prediction in hindi

FAQ

Is IRCTC a good buy?

IRCTC is a great company with good financials. Buying it at dips can definitely make money for its investors. Buying IRCTC at levels of 550 can be a good buy in 2023.

What is the next target of IRCTC?

775 are next important target for IRCTC technically.

Will IRCTC shares rise again?

IRCTC has posted highest ever sales and profits on QoQ and YoY basis and is trading near 52 weeks low. The shares will surely rise in accordance with good results.

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true. We are not SEBI-registered analysts.

Pingback: IRCTC Share Price Target - 2023, 2024, 2025, 2026, 2027, 2030 - STOCKseKHELO