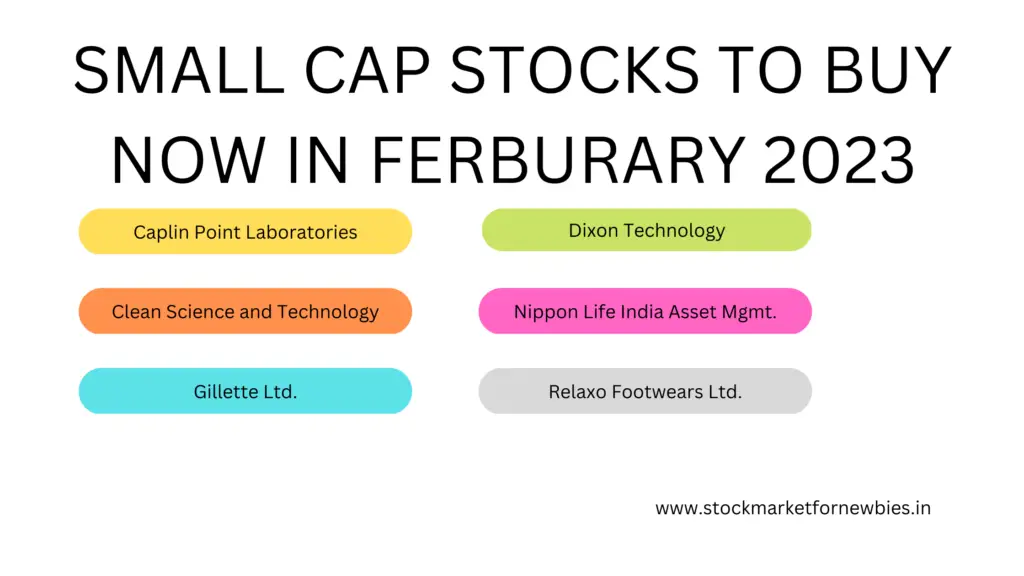

Small cap stocks to buy now for beginners. Caplin point laboratories, Dixon Technology, Clean Science and Technology, Relaxo Footwears, Nippon Life India Asset Management, Gillette.

Caplin Point Laboratories

- Small-cap pharma company with a presence in Latin America, the U.S.A, and Africa is available at a discount of 30% from its lifetime high.

- It has a strong ROCE and ROE of 28% and 22% respectively.

- It is a debt-free company that has shown a profit growth of 23%.

- It is available at a PE of 15.

- The company has posted the highest-ever sales and Profits on both a QoQ basis and a YoY basis.

- The company has high Operating margins of 29%.

- The company has shown CAGR Sales Growth of 32% and CAGR Profit Growth of 49% in the past 10 years.

- The balance sheet is very healthy with reserves grown from Rs. 14 Cr. in 2011 to Rs. 1671 Cr. in 2022 i.e more than 100 times.

- The stock price has grown by a CAGR of 46% in the last 10 years.

- The cash flow is always positive and equivalent to its Net Profits.

- The Company is in strong hands with Promoter’s share being 68% therefore a lot of skin in the game. FIIs and DIIs are close to 3% in their holdings.

- The share can benefit both short-term and long-term investors.

Buy Zone- Rs 640-670 Target – Rs. 1000 Upside- 45%

Dixon Technology

- Dixon Technology the largest manufacturer of LED TVs, LED bulbs, smartphones, CCTV, and medical equipment Is available at 52 weeks low.

- ROCE and ROE of the company are 22% and 21% respectively.

- The company has posted the highest-ever sales, highest-ever operating profit, and highest-ever net profits in March 2022, and TTM on YoY bases.

- Sales have increased by 65% while the Operating profit has increased by 31%.

- The company has shown cagr sales growth of 34% and cagr profit growth of 40% in the past 10 years.

- the company has increased its Reserves from rupees 52 CR on March 12 to Rs. 985 Cr. on March 22.

- The company has a manageable Debt to equity ratio of 0.37.

- everything earned as profit returns to the company in the form of cash flow.

- Promoter’s shareholding is constant while DII have increased their shareholding from 8% to 18%.

- The stock has the potential to give multi-bagger returns to its investors.

Buy zone- Rs. 2400 to 2700 Target RS 6200 upside potential- more than 100%

Clean Science and Technology

- Leading chemical manufacturing company working on developing eco-friendly and minimal pollution-causing chemicals. the company got listed in July 2021 and is currently trading near its IPO price.

- High ROCE and ROE of 46% and 34% respectively.

- Company is debt free with zero promoters pledging.

- The company has posted the highest-ever sales, highest-ever Operating Profit, and highest-ever Net Profit in the quarter of December 2022 on a QoQ basis.

- same is the scenario on a YoY basis.

- The company has high operating margins of 41%.

- CAGR sales growth is 29% and CAGR profit growth is 37% in the last 5 years.

- The company has increased its Reserves from 99 Cr. in March 2016 to 758 Cr. in March 2022.

- The company has CWIP of 42 Cr in line.

- Cashflow has always been positive and in line with the Net Profits.

- More than 78% of shareholding is with its promoters which will be diluted soon.

Buy zone -Rs. 1420- 1540 Target- Rs.2700, Upside Potential-80%

Relaxo Footwears Ltd.

- Relaxo is the largest non-leader footwear manufacturing company in India. It is a leader in value-segment footwear. it owns well-known brands such as Relaxo, Sparx, Flight, and Bahamas.

- Good ROCE and ROE of 17% and 13% respectively.

- The company is debt-free.

- QoQ sales and Net Profits are weak and less than the same quarter of last year.

- YoY sales and profits are not more than last year but almost equal.

- The company has shown a CAGR of 12%in sales growth and 19% in profit growth.

- The company has increased its reserves from Rs. 129 Cr. to Rs. 1735 Cr from 2011 to 2022.

- Fixed assets have increased from Rs. 268 Cr. to Rs. 987 Cr. from 2011 to 2022.

- CWIP of Rs. 40 Cr. is still going on.

- Cashflows have always been positive for all these years.

- The entire company is in strong hands with the public holding just 10%.

- This company could be accumulated in the portfolio every fall.

- Buy Zone – Rs 750- 850 Target – Rs. 1450 Upside Potential- 90%.

Nippon Life India Asset Management.

- The Largest asset management company in India with a total AUM of 3.45 lakh Crores. It is involved in managing funds like ETF’s , Portfolio Manageement Service, alternate investment fund etc.

- Zero debt company has a high ROCE of 30% and ROE of 22%.

- There is a QoQ increase in sales , Operating Profits and Net Profits.

- Sales and Profits have also increased from last year on YoY basis.

- The Profits of company although goes up and down with the share market.

- The company is working at high high OPM of 44%.

- CAGR Sales growth have been 8% and profit growth is 10%.

- The company has doubled its reserves in past 10 years and gives a healthy dividend of 80%.

- Cash from operating activities have always been positive and in line with Net Profits.

- Most of the shares of this company are in very strong hands. Public shareholding is less than 7%.

- The shares could be accumulated at every dip by investors for long term gains.

Buy Zone- Rs. 200-240 Target- Rs.480 Upside potential > 100%

Gilllette India Ltd.

- Well known company which manufactures grooming and oral care products. Its renowned brands are MACH 3, Fusion 5, Guard 3 etc.

- A very high ROCE of 51% and ROE of 35% suggests that company has brilliant products, good management and pricing power.

- This company should be a must in portfolio and should be accumulated at every dips.

- The company has posted the highest-ever sales and Net Profits this year both on a QoQ basis and YoY basis.

- It is a zero-debt company with 74 Cr. CWIP going on. The company is using its own money for expansion.

- The Cashflow has been well equivalent to its Net Profits.

- 75% shareholdings is with the promoters with retailers having only 8% in their hands.

Buy Zone- Rs. 4500-4800 Target- Rs.8100 Upside Potential-75%

Other Small Cap stocks worth investing right now are:-

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true.