Want to invest in Jio financial services but confused, what would be the right price to enter. Impressed by Reliance performance of past many traders want to enter Jio Financial Services stock. Let’s calculate what could be the Share Prices of Jio Financial Services.

Jio Financial Services Share Price

Introduction

Established in 2016 as a subsidiary of Reliance Industries, Jio Financial Services is a prominent non-banking financial company (NBFC) that has become a pivotal player in the financial landscape. Catering to both consumers and merchants, it provides a diverse array of financial solutions, which encompass:

- Consumer Financing: Jio Financial Services extends credit facilities to consumers, facilitating the acquisition of various consumer durables like smartphones, laptops, and televisions.

- Merchant Financing: Recognizing the importance of working capital and inventory financing, Jio Financial Services offers loans tailored to meet the financial needs of merchants.

- Insurance: Jio Financial Services boasts an extensive portfolio of insurance products, ranging from life and health insurance to comprehensive travel coverage.

- Mobile Payments: The company has introduced a user-friendly mobile payments application known as ‘JioMoney,’ simplifying financial transactions for its users.

- Credit Cards: In its commitment to enhancing financial accessibility, Jio Financial Services has launched the ‘Jio Credit Card,’ providing an additional avenue for customers to manage their finances efficiently.

Read More: Stock to buy now : TCS

With its wide-ranging financial services and commitment to innovation, Jio Financial Services has emerged as a key player in the financial sector, catering to the evolving needs of consumers and businesses alike.

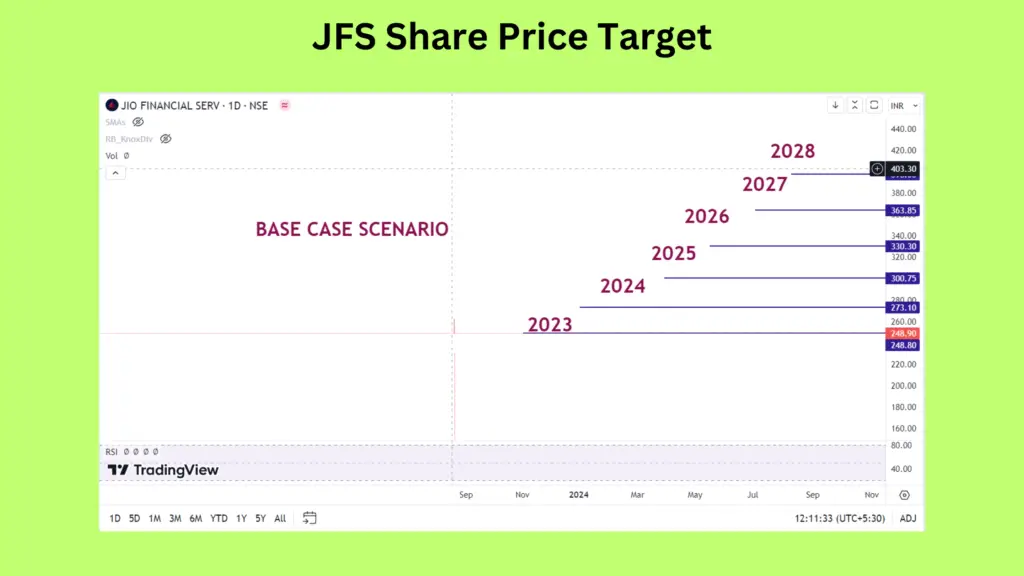

Jio Financial Services Share Price Target 2023

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2023 | 165 | 248 | 331 |

In 2023, the Share Price of JFS can range from 165 – 331. According to our analysts, it is a much hyped stock and is expected to reach its Bull Prices very soon.

Read More : IRCON Intl. Ltd. News

The prime factor driving investors to assign a premium valuation to JFS is because of the unparalleled track record of Reliance. The transformative impact that Reliance had on the telecommunications industry in India is well-known. This history has cultivated investor anticipation for a similar game-changing disruption in the financial sector, spearheaded by Reliance.

However, a crucial aspect demands investor consideration. The financial landscape, especially within the non-banking financial company (NBFC) sphere, is subject to rigorous regulatory oversight. JFS (Jio Financial Services) has been categorized as an upper-layer NBFC, which poses challenges in mirroring banking operations while not being a full-fledged bank.

Jio Financial Services Share Price Target 2024

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2024 | 182 | 273 | 364 |

JFS Share Prices can go upto 364 in 2024. JFS plans to increase its revenue and Net Profits through introduction of new products.

Jio Financial Services has an ambitious vision to introduce a range of novel financial products and services, including personal loans, home loans, and education loans.

The foundation of remarkable companies often lies in the caliber of their leadership. In this pursuit of excellence, JFS is leaving no stone unturned. A significant stride in this direction is the appointment of KV Kamath, the former Chairman of ICICI Bank, to lead the charge.

While time will reveal the success of this endeavor, it’s crucial to acknowledge that this journey won’t be without its unique challenges. The financial landscape of an NBFC (Non-Banking Financial Company) differs substantially from that of a traditional bank.

Read More : Hardwyn Share Price Prediction

Jio Financial Services Share Price Target 2025

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2025 | 200 | 300 | 400 |

In August of 2023, Jio Financial Services embarked on an exciting venture, teaming up with BlackRock to venture into the realm of asset management.

Adding to its impressive lineup of offerings, Jio Financial Services is gearing up for the launch of a brand-new financial tool, the Jio Platinum Card.

Further solidifying its commitment to broader financial inclusion, the company is strategically extending its reach into rural areas, aiming to serve a more extensive customer base.

JFS plans to double its revenue from current levels. The company has high PAT Margins of around 50% which will soar the Net Profits and hence the Share Price of the company.

Read More : SBFC Share Price Prediction

Jio Financial Services Share Price Target 2030

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2030 | 322 | 483 | 644 |

Another compelling factor fueling the demand and excitement surrounding JFS is the widespread belief among investors that the substantial base of approximately 250 million retail customers and 440 million telecom subscribers holds the potential for a rapid and robust business expansion.

This belief and profitability will together take Share Prices of JFS to new highs.

Conclusion

Jio Financial Services is well-positioned to grow rapidly in the coming years. It has a strong parent company, Reliance Industries, which provides it with financial backing and access to a large customer base. The company also has a strong management team with a proven track record of success.

Overall, Jio Financial Services is a well-run company with a strong growth potential. It is expected to play a major role in the Indian financial services sector in the coming years.

Read More : Balaji Amines Share Price Target

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true. We are not SEBI-registered research analysts.