Mankind Pharma share Buy Zone:- 750 Target:- 6070

Mankind Pharma a renowned pharma company is now listed on NSE and BSE. On the very first day of listing, it showed a bumper debut giving its retailers a massive gain of 31%.

In this article, let us find out the share price targets of Mankind Pharma so that retail investors know what are the right points of entry and exit in this share after listing.

Incorporated in 1991, Mankind Pharma is the fourth-largest pharmaceutical company in terms of domestic sales. It is involved in developing, manufacturing, and marketing of formulations for acute and chronic diseases.

It is known through its famous brands like Prega News, Manforce condoms, Gas-O-Fast, etc.

Read More: Gland Pharma Share Price Prediction

Mankind Pharma Share Price

About Mankind Pharma

Mankind Pharma is involved in manufacturing of anti-infective, cardiovascular, gastrointestinal, antidiabetics, vitamins, minerals, etc.

It has around 21 brands like Manforce (Rx), Moxikind-CV, Amlokind-AT, Unwanted-Kit, Candiforce, Gudcef, Glimestar-M, Prega News, Codistar, Nurokind-Gold, Nurokind Plus-RF, Monticope, Telmikind-H, Telmikind, Gudcef-CV, and Unwanted-72, etc.

It has 25 manufacturing facilities with Pan India presence.

Key Matrics

| ROCE | 30.6 |

| ROE | 23.8 |

| Debt To Equity | 0.11 |

| Profit Growth | 22% |

Mankind Pharma Share Price Target

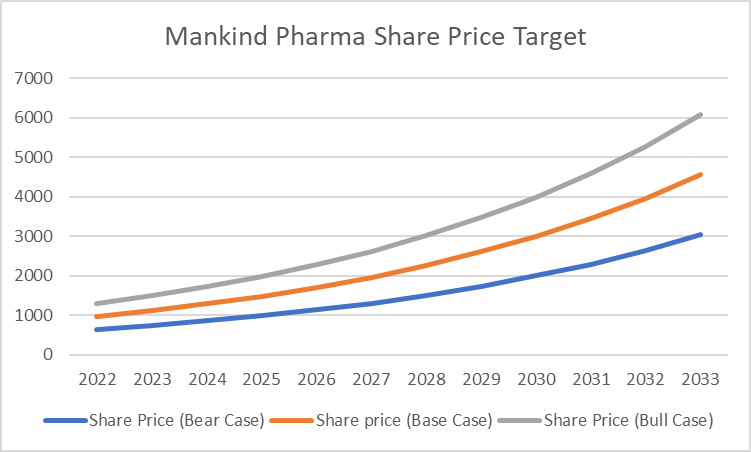

According to our calculations, the following are the share prices Mankind Pharma can achieve in upcoming years in all Bear Case, Base Case, Bull Case.

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2022 | 652 | 978 | 1305 |

| 2023 | 750 | 1125 | 1500 |

| 2024 | 863 | 1294 | 1725 |

| 2025 | 992 | 1488 | 1984 |

| 2026 | 1141 | 1711 | 2282 |

| 2027 | 1312 | 1968 | 2624 |

| 2028 | 1509 | 2263 | 3018 |

| 2029 | 1735 | 2603 | 3470 |

| 2030 | 1995 | 2993 | 3991 |

| 2031 | 2295 | 3442 | 4590 |

| 2032 | 2639 | 3958 | 5278 |

| 2033 | 3035 | 4552 | 6070 |

Here are three scenarios according to us. These are the share prices Mankind Pharma can achieve when the share market is bearish or neutral or bullish towards this company.

This is a conservative approach we have taken. Market may become extremely bearish bringing its share prices further down or extremely bullish taking its share prices up further.

This is a range according to us in which its share price can move in a particular time.

Read More :- ICICI Lombard General Share Price Target

Assumptions to Calculate Mankind Pharma Share Price Target

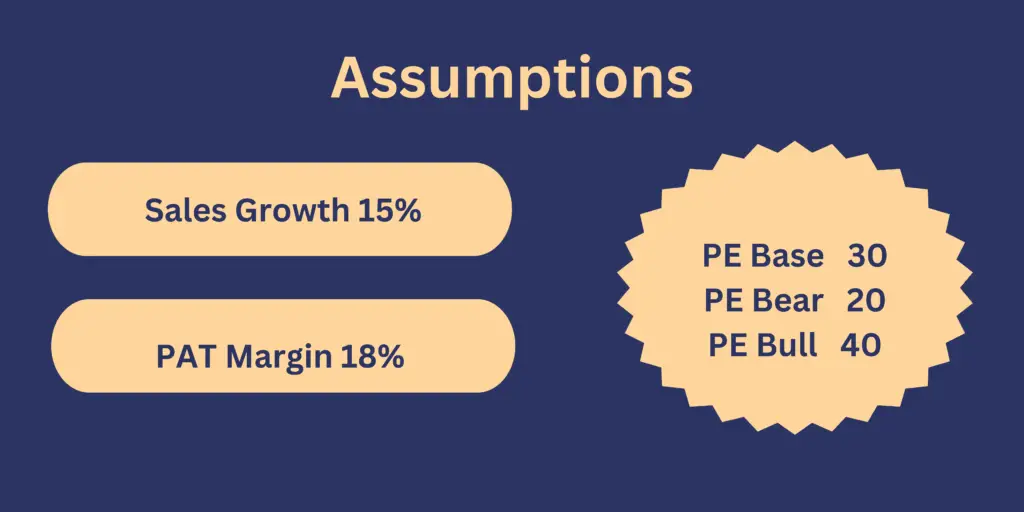

The above said share prices are calculated on basis of certain assumptions which are as follows:-

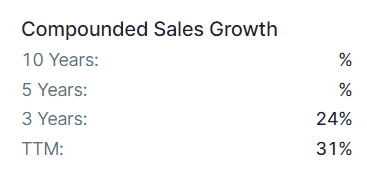

Assumed Sales Growth

In the past 3 years, Mankind Pharma has shown a CAGR Sales of 24% and 31% in TTM. Keeping conservative mindset let us assume Mankind Pharma will increase its sales by 15% every year for next 10 years consistently. It may show more growth but 15% seems more practical to us.

Assumed Sales Growth = 15%

PAT Margins

Mankind Pharma has Operating Margin of 18 to 25% which is quite good. But to calculate earning it need to deduct interest, taxes and depreciation etc. So we need to take PAT margins.

PAT Margins of Mankind Pharma has been ranging from 13-20% with 18% as average.

PAT Margin = 18%

PE

Mankind Pharma is recently listed so we do not have any historic data for the same. The share market usually gives Pharma Companies PE ranging from 20 to a maximum of 60. So accordingly let us take:-

PE Base Case = 30

PE Bear Case = 20

PE Bull Case = 40

Read More : Bajaj Finance Share Price Prediction

Number of Equity Shares

Number of equity shares = 40.05 Cr.

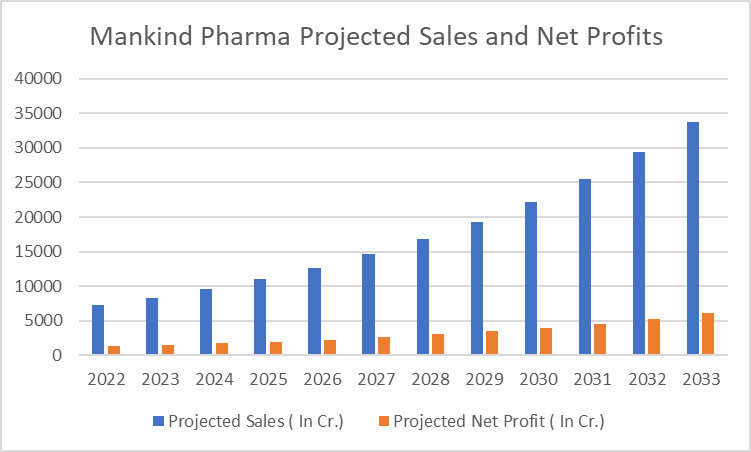

Mankind Pharma Projected Sales and Net Profits

According to our calculations, Mankind Pharma will make the following Sales and Net Profits in the future.

Mankind Pharma sales will increase at least by 15% YoY and it will make Profits with at least 18% margins.

| Year | Projected Sales ( In Cr.) | Projected Net Profit ( In Cr.) |

| 2022 | 7257 | 1306 |

| 2023 | 8346 | 1502 |

| 2024 | 9597 | 1728 |

| 2025 | 11037 | 1987 |

| 2026 | 12693 | 2285 |

| 2027 | 14596 | 2627 |

| 2028 | 16786 | 3021 |

| 2029 | 19304 | 3475 |

| 2030 | 22199 | 3996 |

| 2031 | 25529 | 4595 |

| 2032 | 29359 | 5285 |

| 2033 | 33762 | 6077 |

Mankind Pharma Share Price Target 2023

| Year | Share PriceBear Case | Share PriceBase Case | Share PriceBull Case |

| 2023 | 750 | 1125 | 1500 |

Mankind Pharma got listed and trading started on 9 May 2023 and on its very first day its share price was 1422. Its valuation is already on the higher side and the investors should wait for levels around 750 before investing.

ROCE being 30% shows that the company and its products are great. Management is well qualified and the products also have great value in the market.

Debt is very low as compared to company’s reserves and share capital. It can be well managed

Mankind Pharma Share Price Target 2025

| Year | Share PriceBear Case | Share PriceBase Case | Share PriceBull Case |

| 2025 | 992 | 1488 | 1984 |

By the year 2025, the share prices of Mankind Pharma will vary from 992 to 1982 on the higher side. Investors can use these as reference points for buying and selling.

One can buy whenever the share price touches or goes below bear case and can sell it whenever it touches the bull case targets.

The company is showing constant growth in its sales and is increasing its fixed assets continuously.

CWIP of 384 Cr. is going on which is further going to add to the sales once it manufacturing becomes operational.

Mankind Pharma Share Price Target 2030

| Year | Share PriceBear Case | Share PriceBase Case | Share PriceBull Case |

| 2030 | 1995 | 2993 | 3991 |

Debt is being repaid constantly. Once it is repaid all the interest is added to the Net Profit thus increasing them.

With increase in sales , Profits also increases and that to with increased rates.

Mankind Pharma has posted highest ever sales and highest ever profits in March ’22.

Reserves and fixed assets are also highest ever and increasing every year.

Mankind Pharma Share Price Target 2033

| Year | Share PriceBear Case | Share PriceBase Case | Share PriceBull Case |

| 2033 | 3035 | 4552 | 6070 |

Cash Flow of the company is always positive and in line with the net profits.

Balance sheet is clean and well maintained.

A lot of growth is instore for Mankind Pharma and it can very well touch the levels of 6070.

Conclusion

Although Mankind Pharma has very strong fundamentals but currently it is trading at very high valuations.

Its current PE comes out to be 43 which is more than industrial PE. So this stock seems very expensive at the current valuation.

Investors should consider buying this stock whenever it reaches near the bear case share price target. For example, it would be a good buy at Rs. 750 in 2023.

We prefer using bear case targets as our entry points and bull case targets as our exit points.

Click Here to read Mankind Predictions in Hindi

FAQ

Is Mankind Pharma a listed company?

Yes, Mankind pharma is a listed company. It is listed both on NSE and BSE. Its trading in secondary market has started from 9 May 2023.

Read More : IEX Share Price Target

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true. We are not SEBI-registered analysts.