In this article, we will calculate the share price target of Bajaj Finance in the next 5 and 10 years. Here we will try to figure out : –

- What is the future of Bajaj Finance?

- Is Bajaj Finance overvalued or undervalued?

- When to invest in Bajaj Finance?

Buy Zone:- 5200

Target :- 68000 in the next 10 years.

Bajaj Finance Share Price Target Today

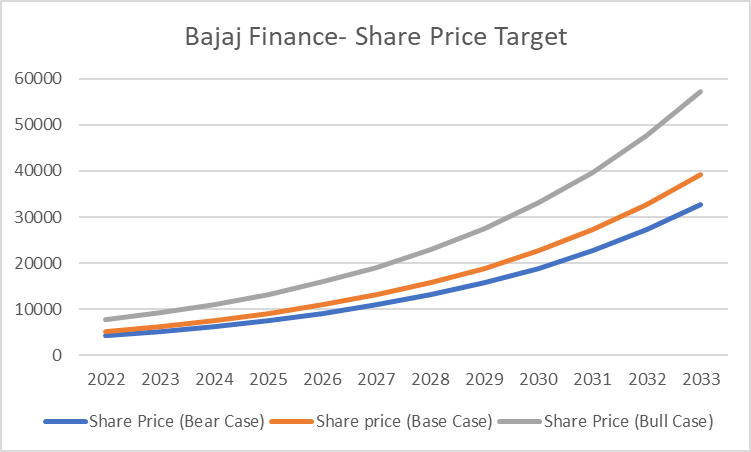

Bajaj Finance Share Price Target

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2022 | 4392 | 5270 | 7686 |

| 2023 | 5270 | 6325 | 9223 |

| 2024 | 6325 | 7589 | 11068 |

| 2025 | 7589 | 9107 | 13281 |

| 2026 | 9107 | 10929 | 15938 |

| 2027 | 10929 | 13115 | 19125 |

| 2028 | 13115 | 15737 | 22950 |

| 2029 | 15737 | 18885 | 27540 |

| 2030 | 18885 | 22662 | 33049 |

| 2031 | 22662 | 27194 | 39658 |

| 2032 | 27194 | 32633 | 47590 |

| 2033 | 32633 | 39160 | 57108 |

About Bajaj Finance

Bajaj Finance is among the leading NBFCs in India. it is engaged in the business of lending with a diversified portfolio across retail, SME, and commercial customers.

Bajaj Finance has both an urban and rural presence.

It is into lending consumer electronics, furniture, and digital products.

It provides mortgages like home loans, against properties, developer finance, etc.

Under commercial lending, the company provides loans to auto component manufacturers, light engineering industries, Financial Institutions, Pharma and specialty chemical Industries, etc.

Bajaj Finance is the largest financer of Bajaj Auto for two-wheelers and three-wheelers.

It has reported one of the lowest NPAs in the NBFC industry.

| Market Capitalization | 3,57,473 |

| ROE | 17.5 |

| Debt to Equity | 3.81 |

| Profit Growth | 80.8 |

| PEG Ratio | 1.08 |

| Pledged Percentage | 0 |

Calculating Bajaj Finance Share Price Target

Using the historical data, we will try to calculate Bajaj Finance’s future performance and calculate its future share prices.

We will do calculations in the following order : –

- Future Sales

- Future Net Profits

- Market capitalization

- Share Price Target

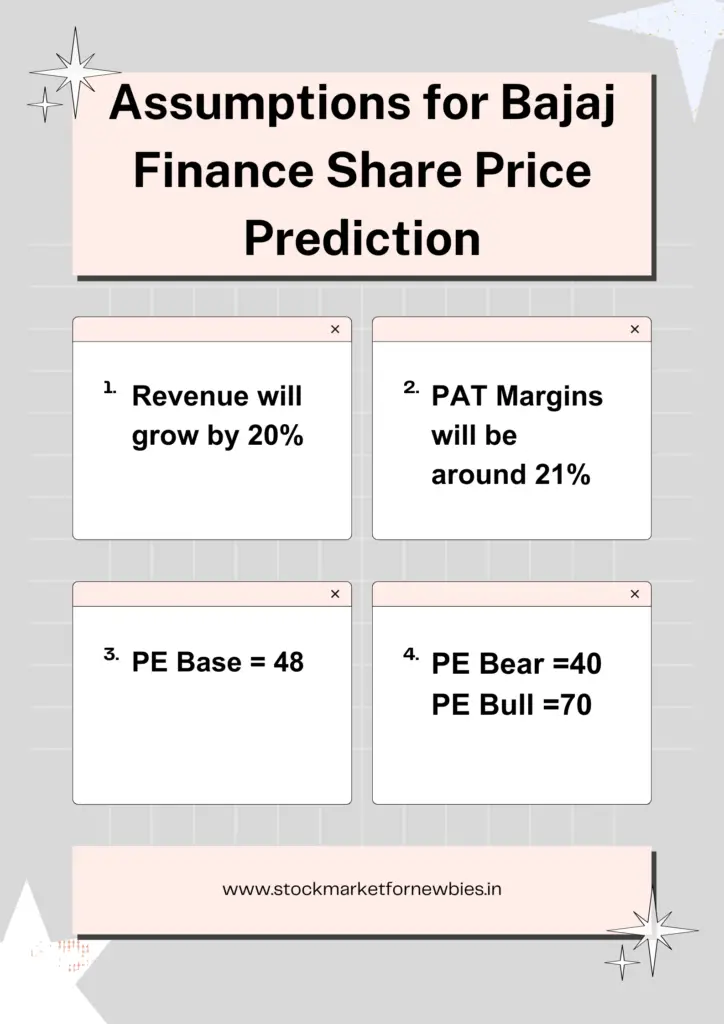

Assumptions

For this, we need to make some assumptions.

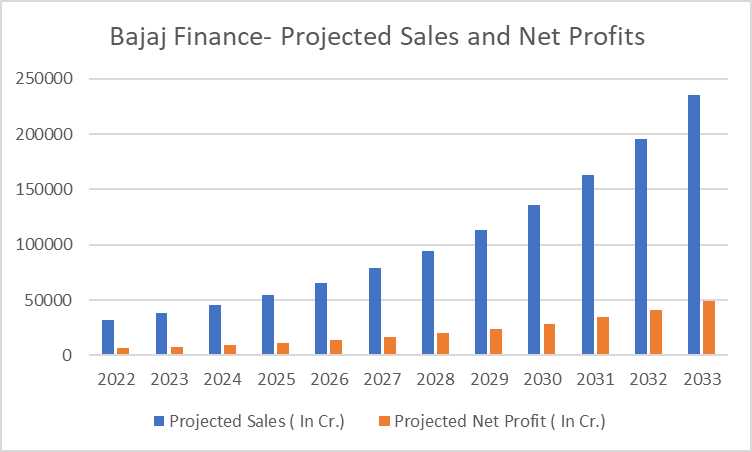

Sales Growth

Bajaj Finance is involved in the credit business which will improve more with an increase in the per capita income of individuals. When the per capita income of people will increase they will try to improve their living standard and buy appliances, vehicles, etc. at EMI.

Bajaj Finance can easily show a sales growth of 20% in years to come.

PAT Margin

Historically PAT Margins of the company had been between 17- 28%. Let’s take an average of 21% as PAT Margin for calculation.

PE

Bajaj Finance has always given good PE of 21-95 by the share market with median PE being 48. In our case, taking a conservative mode let’s take

PE Base as 48,

PE Bear as 40,

PE Bull as 70.

You may take as you prefer and do calculations with the same formula.

No. of Shares

Bajaj Finance has 60.5 Cr. shares of Face Value of Rs. 2.

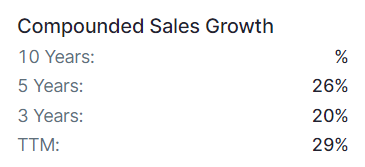

Bajaj Finance Projected Sales and Net Profits

Bajaj Finance sales have been growing at CAGR of 26% for the past 5 years. Below would be the sales if the sales keep growing @ 20% per annum and making profits at the margins of 21%

Projected Sales (Next Year)= Sales Current Year + X% of Sales Current Year, where X= Assumed Sales Growth.

Eg:- Projected Sales 2023 = Sales 2022 + 20 % Sales 2022.

Sales 2022= 31633 Cr.

Data taken from www.screener.com

Projected Profit = Projected Sales X Profit After Tax Margin (in %)

PAT Margin = 0.21

| Year | Projected Sales ( In Cr.) | Projected Net Profit ( In Cr.) |

| 2022 | 31633 | 6643 |

| 2023 | 37960 | 7972 |

| 2024 | 45552 | 9566 |

| 2025 | 54662 | 11479 |

| 2026 | 65594 | 13775 |

| 2027 | 78713 | 16530 |

| 2028 | 94456 | 19836 |

| 2029 | 113347 | 23803 |

| 2030 | 136016 | 28563 |

| 2031 | 163219 | 34276 |

| 2032 | 195863 | 41131 |

| 2033 | 235036 | 49358 |

Bajaj Finance Share Price Target Base Case

When Bajaj Finance would be giving the above sales and net profits and the market is quite neutral about its share. Supposing the market is giving it a median PE of 45 we can calculate Mcap and share Price using formulas below,

Market Capitalization (Base Case) = Projected Profit X PE (Base case)

Here PE = 45

Share Price (Base Case) = Market Capitalization (Base Case) / No. of Shares

Here No. of shares = 60.5 cr.

Same formulas could be used to calculate MCap and Share Prices in Bear and Bull Case

| Year | Mcap ( Base Case) ( In Cr.) | Share price (Base Case) |

| 2022 | 318861 | 5270 |

| 2023 | 382633 | 6325 |

| 2024 | 459159 | 7589 |

| 2025 | 550991 | 9107 |

| 2026 | 661189 | 10929 |

| 2027 | 793427 | 13115 |

| 2028 | 952113 | 15737 |

| 2029 | 1142535 | 18885 |

| 2030 | 1371042 | 22662 |

| 2031 | 1645251 | 27194 |

| 2032 | 1974301 | 32633 |

| 2033 | 2369161 | 39160 |

Bajaj Finance Share Price Target Bear Case

This becomes the scenario when the market becomes bearish about the company and start giving it a lower PE.

We will do similar calculations using PE as 40.

| Year | Mcap (Bear Case) ( In Cr.) | Share Price (Bear Case) |

| 2022 | 265717 | 4392 |

| 2023 | 318861 | 5270 |

| 2024 | 382633 | 6325 |

| 2025 | 459159 | 7589 |

| 2026 | 550991 | 9107 |

| 2027 | 661189 | 10929 |

| 2028 | 793427 | 13115 |

| 2029 | 952113 | 15737 |

| 2030 | 1142535 | 18885 |

| 2031 | 1371042 | 22662 |

| 2032 | 1645251 | 27194 |

| 2033 | 1974301 | 32633 |

Bajaj Finance Share Price Target Bull Case

A bullish market brings rally in the stock and always offers it a higher PE. Good news for a particular company leads to this kind of bull run.

We will use PE = 70 for calculations.

Read More: Gland Pharma Share Price Prediction

| Year | Mcap (Bull Case) ( In Cr.) | Share Price (Bull Case) |

| 2022 | 465005 | 7686 |

| 2023 | 558006 | 9223 |

| 2024 | 669607 | 11068 |

| 2025 | 803529 | 13281 |

| 2026 | 964235 | 15938 |

| 2027 | 1157081 | 19125 |

| 2028 | 1388498 | 22950 |

| 2029 | 1666197 | 27540 |

| 2030 | 1999437 | 33049 |

| 2031 | 2399324 | 39658 |

| 2032 | 2879189 | 47590 |

| 2033 | 3455027 | 57108 |

Bajaj Finance Share Price Target 2023

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2023 | 5270 | 6325 | 9223 |

Bajaj Finance is currently down by 25% from its recent highs of 7800 levels. It is right now available at the level of 5900 which seems quite attractive to us.

It had shown an upward move by taking support at levels of 5500. If it falls further it can take support at the level of 5267.

Read :- Zomato Share Price Prediction

Bajaj Finance Share Price Target 2025

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2025 | 7589 | 9107 | 13281 |

Bajaj Finance is able to deliver an ROE of 13 – 22% which is good.

It has increased its revenue QoQ basis every quarter.

The company has increased its profits every quarter with a financing profit of at least 30% which is highly commendable.

It has reputed management and further good could be expected from it.

Bajaj Finance Share Price Target 2027

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2027 | 10929 | 13115 | 19125 |

Bajaj Finance has a PAN India presence and has announced its expansion for financing two-wheelers of other brands as well. This will increase its revenue considerably.

Its Profit and Loss statement shows a wonderful growth in Revenue and Profits.

Revenues have grown by 7 times in the last 8 years.

PBT and Net Profits have grown by 10 times during this period.

The same is expected in years to come.

The credit market is expected to grow @ 12.4% CAGR by 2027. This will directly benefit the business of NBFCs.

Read More :- ICICI Lombard General Share Price Target

Bajaj Finance Share Price Target 2030

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2030 | 18885 | 22662 | 33049 |

The share price will range from a range of 18k to 33k which is a tremendous growth.

Bajaj Finance has grown its EPS by 10 times from Rs. 17 in 2015 to 177 in TTM.

The balance sheet is excellent, where it has grown its reserves 10 times and increased its borrowings.

Here increased borrowing is a good sign because in NBFC business they take loans at the lower interest rate and give loans at higher rates.

Bajaj Finance is constantly developing new product lines and innovative product mix.

It is trying to spread its reach in U.P. , Bihar, and NE.

Read More :- Manyavar Vedant Fashions share Price Target

Bajaj Finance Share Price Target 2033

| Year | Share Price (Bear Case) | Share price (Base Case) | Share Price (Bull Case) |

| 2033 | 32633 | 39160 | 57108 |

Bajaj Finance has a stable shareholding pattern where most of the shares are in strong hands i.e Promoters, FIIs and DIIs. The Public has just 11% of the stake.

Bajaj Finance and its subsidiaries are trying to spread in all locations with all products.

It is trying to dominate all the platforms of consumer presence and generate a lot of business from the digital platform.

Read More:- IRCTC Share Price Target

FAQ

Is it good to invest in Bajaj Finance now?

Bajaj Finance is trading 28% down from its life time high. It has rebound after taking support from levels of 5200. It is fundamentally a good stock. It has posted highest ever results QoQ and YoY in 2022 and TTM. It can be bought at current levels of 5900 and if kept till lifetime high i.e 8000, it can give a profit of 36%.

What is the future of Bajaj Finance?

Bajaj Finance is in the credit business of giving loans like housing loans, auto loans, etc. With the increase in per capita income, there would be an increase in demand for buying houses, cars, two-wheelers, home appliances at EMIs. It is a strong company with good management, and excellent product portfolio. It has excellent growth potential . It is a low risk stock which can be bought at every dip.

Why is Bajaj share falling?

Everything is fine in Bajaj Finance. Strong balance sheet, highest ever revenue, highest ever profits, increasing reserves, increasing fixed assets. It happens in the stock market , a company posts good results and its share prices falls.

On back testing we found that whenever share prices of Bajaj Finance falls by 20-30%, their is a immediate rally after it. This seems a good opportunity to us

Conclusion

- Bajaj Finance is a fundamentally strong company with a lot of growth potential.

- Credit Market is going to grow with increased per capita income and hence the business of companies like Bajaj Finance.

- It comes under the top 5 players in all segments of its product line.

- It has a healthy balance sheet and an ever-growing Profit and Loss statement.

- Every investor should keep Bajaj Finance on his radar and consider investing in it at every dip.

- The above-given share prices could be used as a reference point of how much the share price could fluctuate in a particular year.

- If the share price falls down more than the base case scenario then it is a golden opportunity to buy. (Check the financials before taking a decision)

Read More : IEX Share Price Target

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true. We are not SEBI-registered analysts.