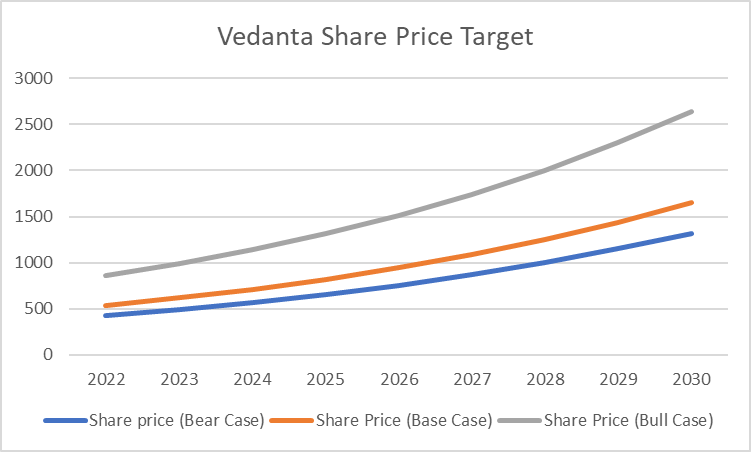

Manyavar Vedant Fashions Buy Range:- Rs. 400 Target:- Rs. 2600 by 2030. Manyavar Vedant Fashions Share Price.

In this article we will analyze Manyavar Vedant Fashions business, Calculate its future share prices and analyze is it worth investing.

Manyavar Vedant Fashions Share Price Today

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2022 | 432 | 540 | 864 |

| 2023 | 497 | 621 | 993 |

| 2024 | 571 | 714 | 1142 |

| 2025 | 657 | 821 | 1314 |

| 2026 | 755 | 944 | 1511 |

| 2027 | 869 | 1086 | 1737 |

| 2028 | 999 | 1249 | 1998 |

| 2029 | 1149 | 1436 | 2297 |

| 2030 | 1321 | 1651 | 2642 |

About Manyavar Vedant Fashions

- Vedant Fashions offer indian celebration wear with a wide spectrum of products for men and women wear.

- It has various home grown brands like Manyavar, Twamev, Manthan, Mohey, Mebaz etc.

- 80% of revenue comes from Manyavar brand

- Its products include Indo westerns, sherwanis, kurtas, jackets in men’s wear.

- In women’s wear, items like lehengas, sarees, stitched suits, gowns, kurtis etc.

- It also upscales its sales by selling accessories like jutties, safas etc.

| Market Capitalization | 27,795 |

| ROCE | 32.8 |

| Debt to Equity | 0.22 |

| Profit Growth | 52.1 |

| PEG Ratio | 2.93 |

| Pledged Percentage | 0 |

- Annual sales increased YOY ever since 2016 to TTM except in 2021 because of COVID reasons.

- Highest ever sales, operating profits, Net profits etc. in 2022 and TTM .

- Reserves has gone around 5 times since 2016.

- Borrowings are manageable.

- Positive cashflow always.

- Promoters holdings very high around 85%

Read More:- Lux Industries Share Price Prediction

Calculating Manyavar Vedant Fashions Share Price Target

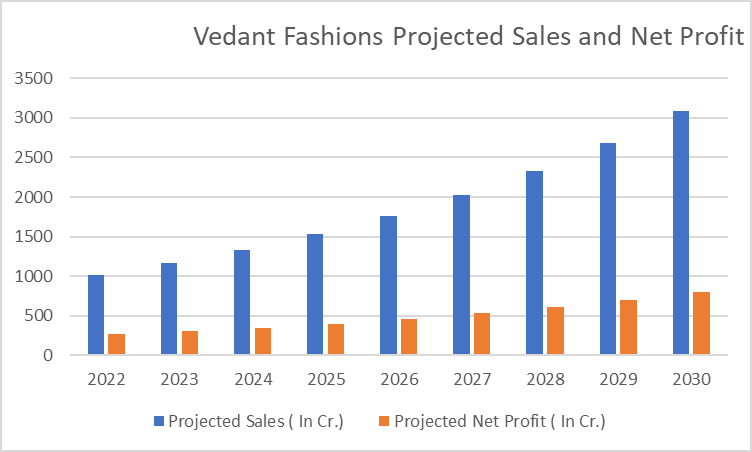

We will now try to calculate Manyavar’s share price target by predicting its future sales using historical data. For this, we need do some assumptions like assumed sales growth, PAT margins and the PE the market would likely give it.

Assumptions

Assumed Sales Growth

Here company had shown fewer sales growth in the last 3 years. This is because of the COVID-19 and lockdown that was witnessed during this period.

Sales growth in TTM is 42% which shows there is a lot of sales potential.

We Indians normally spend a lot of money in marriages and this trend is increasing in the middle class families to which this company is catering the most.

According to us Manyavar can easily show sales growth of 15% for the next 10 years to come.

Assumed Sales Growth = 15%

Profit After Tax Margin

Operating Margins are quite high around 45-50% for Manyavar but to calculate EPS we need PAT Margins.

PAT margins range from 20-32% in the past 5 years with average being 26%.

Let’s take average as out PAT margin for calculations.

PAT margins = 26%

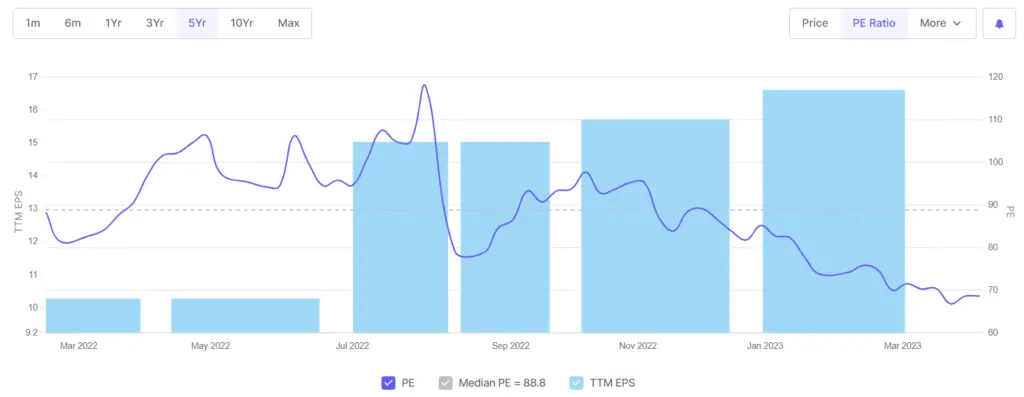

PE

PE of the company has been in the range of 68-118 which seems very high to us. Median PE had been 88, again very high .

- Base Case – Being conservative and keeping our predictions low and practical, we take Base PE = 50

- Bear Case – Here 40 seems perfect in the bear case.

- Bull Case – We will assume 80 as Bull case PE for our calculations

Number of Shares

The company has 24.3 Cr. of shares.

Formulas’s used for Calculating Manyavar Vedant Fashions Share Price Target

- Projected Sales (Next Year)= Sales Current Year + X% of Sales Current Year, where X= Assumed Sales Growth.

Eg:- Projected Sales 2023 = Sales 2022 + 15 % Sales 2022.

- Projected Profit = Projected Sales X Profit After Tax Margin

- Market Capitalization (Base Case) = Projected Profit X PE (Base case)

- Share Price (Base Case) = Market Capitalization (Base Case) / No. of Shares

- Historic data can be fetched from www.screener.com

Manyavar Vedant Fashions Projected Sales and Net Profits

| Year | Projected Sales ( In Cr.) | Projected Net Profit ( In Cr.) |

| 2022 | 1009 | 262 |

| 2023 | 1160 | 302 |

| 2024 | 1334 | 347 |

| 2025 | 1535 | 399 |

| 2026 | 1765 | 459 |

| 2027 | 2029 | 528 |

| 2028 | 2334 | 607 |

| 2029 | 2684 | 698 |

| 2030 | 3087 | 803 |

Read More :- ICICI Lombard General Share Price Target

Manyavar Vedant Fashions Share Price Target Base Case

| Year | PE (base case) | Mcap ( Base Case) ( In Cr.) | Share price (Base Case) |

| 2022 | 50 | 13117 | 540 |

| 2023 | 50 | 15085 | 621 |

| 2024 | 50 | 17347 | 714 |

| 2025 | 50 | 19949 | 821 |

| 2026 | 50 | 22942 | 944 |

| 2027 | 50 | 26383 | 1086 |

| 2028 | 50 | 30340 | 1249 |

| 2029 | 50 | 34891 | 1436 |

| 2030 | 50 | 40125 | 1651 |

Manyavar Vedant Fashions Share Price Target Bear Case

| Year | PE (Bear Case) | Mcap (Bear Case) ( In Cr.) | Share Price (Bear Case) |

| 2022 | 40 | 10494 | 432 |

| 2023 | 40 | 12068 | 497 |

| 2024 | 40 | 13878 | 571 |

| 2025 | 40 | 15959 | 657 |

| 2026 | 40 | 18353 | 755 |

| 2027 | 40 | 21106 | 869 |

| 2028 | 40 | 24272 | 999 |

| 2029 | 40 | 27913 | 1149 |

| 2030 | 40 | 32100 | 1321 |

Manyavar Vedant Fashions Share Price Target Bull Case

Manyavar Vedant Fashions Share Price Target 2023

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2023 | 497 | 621 | 993 |

- Manyavar has shown TTM sales growth of 42% and TTM sales are 403 Cr. which are far more than our predicted sales for 2023 are just 302 Cr. Rs.1100 which are much more than our valuations.

- This is because we are calculating share price using sales growth as 15% while it had been 42% in TTM.

Manyavar Vedant Fashions Share Price Target 2024

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2024 | 571 | 714 | 1142 |

- Manyavar has first movers advantage in this sector It has large presence in EBO’s (Exclusive Brand Outlets). Manyavar is the only brand with more than 500 EBOs.

- It has a total control over its value chain. Its products like sherwani’s , lehengas etc. are embellished with alot of zardosi work which is done by specific artisans.

- Hence it has a competitive advantage and can sustain the growth it is showing.

Read More:- IRCTC Share Price Target

Manyavar Vedant Fashions Share Price Target 2025

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2025 | 657 | 821 | 1314 |

- It is a asset light model and donot need a lot of money for capex.

- It has very high gross margins which make it a profitable business and profit growth will keep coming.

Manyavar Vedant Fashions Share Price Target 2030

| Year | Share price (Bear Case) | Share Price (Base Case) | Share Price (Bull Case) |

| 2030 | 1321 | 1651 | 2642 |

- Branding is taken well care of through brand ambassadors like Ranvir Singh, Alia Bhatt, Kartik Aryan, Anushka Sharma etc.

- A wide range of portfolio catering middle class, and the upper middle class is built for maximum benefits.

Conclusion

- The business model is good but we need to look at the valuations carefully. According to us it is very highly valued.

- Increasing competition may effect its business margins.

- Scaling up Mohey its women premium brand is a bit on the difficult side.

- Branding is a strong point for Manyavar.

- Investing at the right valuations is the only way to make money in this stock.

Use the link to open a Demat account in Zerodha.

Disclaimer- All investments and trading in the stock market involve risk. Any decision to place a trade in the financial markets, including trading in stock should only be made after thorough research. Trading strategies or related information mentioned in the article is for informational purposes only. Use your due diligence before investing. These are just predictions. They may or may not be true. We are not SEBI-registered analysts.